For small businesses in the United States, cash flow is more than just a financial metric, it is the lifeline that keeps operations running. Many profitable businesses fail not because they lack customers, but because they run out of cash at the wrong time. This is where cash flow forecasting becomes essential.

In this practical guide, we explain what cash flow forecasting is, why it matters for US small businesses, and how to build a reliable forecast that supports smarter decision-making and long-term growth.

What Is Cash Flow Forecasting?

Cash flow forecasting is the process of estimating how much cash will flow into and out of your business over a specific period, weekly, monthly, quarterly, or annually.

Unlike profit projections, cash flow forecasts focus strictly on when money is received and when it is paid out.

For small businesses, this forecasting helps answer critical questions:

- Will we have enough cash to cover payroll next month?

- Can we afford to invest in new equipment?

- When might we face a cash shortfall?

Accurate forecasting is a core pillar of effective small business cash flow management.

Read More: Cash Flow Management Strategies Every Small Business in the USA Should Implement

Why Cash Flow Forecasting Is Critical for US Small Businesses

In the US market, small businesses face unique challenges such as fluctuating demand, delayed customer payments, rising interest rates, and seasonal revenue cycles. Without proper forecasting, these challenges can quickly turn into financial stress.

Key benefits of Cash Flow Forecasting include:

- Preventing cash shortages before they happen.

- Improving vendor and payroll planning.

- Supporting loan applications and investor discussions.

- Allowing proactive financial decisions rather than reactive ones.

Strong financial forecasting for US business owners creates stability and confidence, even during economic uncertainty.

Common Cash Flow Challenges Small Businesses Face

Many small businesses struggle with cash flow, not because they lack sales, but because money does not move in and out at the right time. Below are the most common challenges US small businesses face:

- Late customer payments, especially in B2B contracts with long payment terms.

- Seasonal revenue fluctuations create uneven monthly income.

- High fixed expenses such as payroll, rent, insurance, and utilities.

- Unexpected costs, including tax payments, repairs, or compliance fees.

- Overdependence on a few clients increases the risk if payments are delayed.

- Poor cash flow forecasting leads to reactive financial decisions.

Without addressing these issues, even profitable businesses can experience cash shortages that disrupt daily operations and limit growth opportunities.

Types of Cash Flow Forecasts

Cash flow forecasts can be created for different time horizons, depending on a business’s needs and financial complexity. Each type serves a distinct purpose in effective cash flow planning.

Short-Term Cash Flow Forecast (Weekly or 13-Week)

This forecast focuses on immediate cash inflows and outflows. It helps small businesses manage payroll, vendor payments, rent, and other near-term obligations while identifying potential cash shortages early.

Medium-Term Cash Flow Forecast (3–6 Months)

A medium-term forecast supports operational planning. It is useful for budgeting marketing expenses, managing inventory purchases, and preparing for seasonal fluctuations or upcoming tax payments.

Long-Term Cash Flow Forecast (12 Months or More)

Long-term forecasting aligns cash planning with strategic goals. It helps businesses evaluate expansion plans, hiring decisions, equipment investments, and funding requirements.

Using a combination of all three forecasts gives small businesses better visibility, stronger control, and greater confidence in managing cash flow throughout the year.

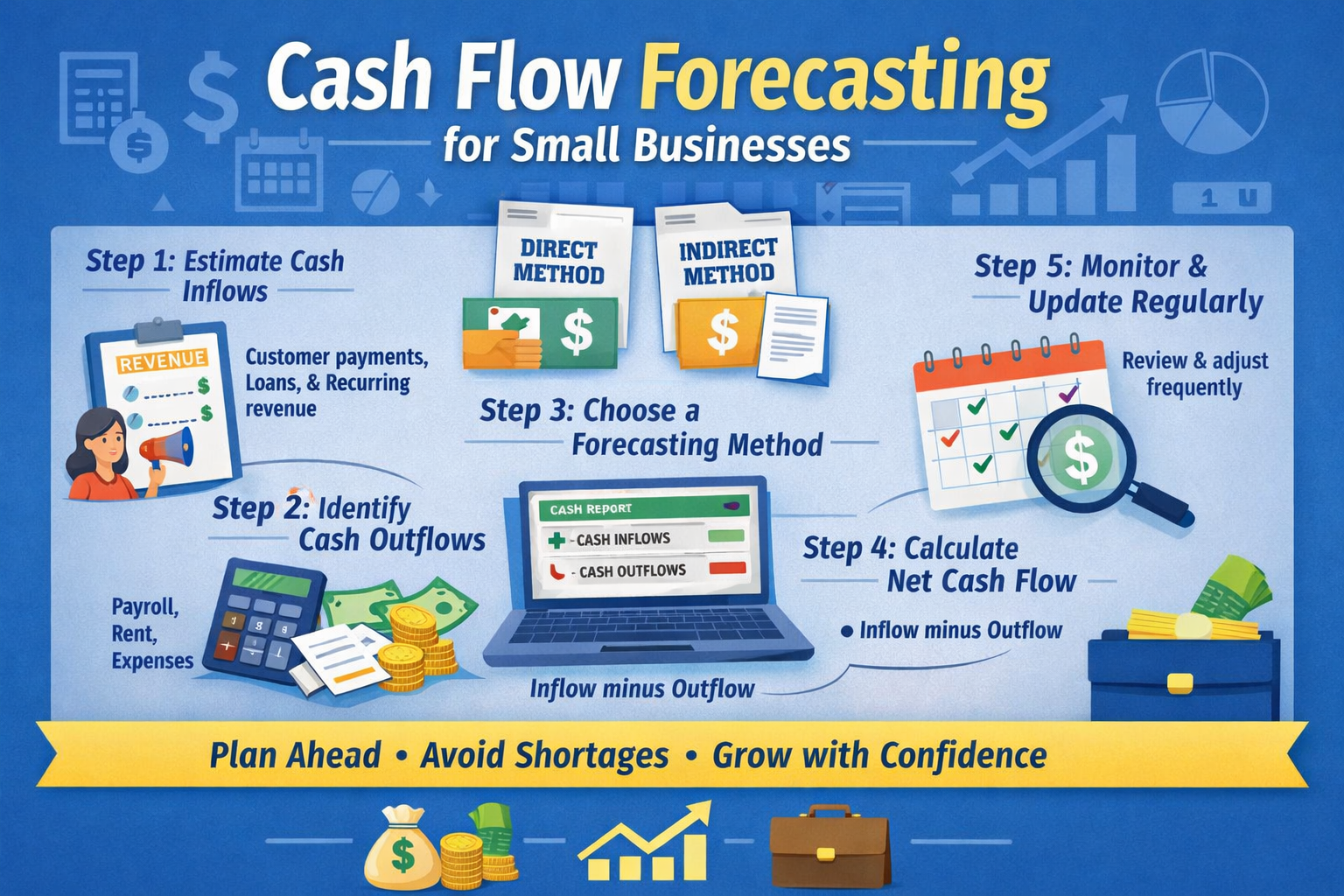

Step-by-Step Guide to Cash Flow Forecasting

Cash flow forecasting helps small businesses plan, avoid cash shortages, and make informed financial decisions. Follow this practical step-by-step approach to build an accurate and reliable cash flow forecast.

Step 1: Estimate Cash Inflows

Start by listing all expected sources of cash. This includes customer payments, recurring revenue, loan proceeds, grants, or tax refunds. Base your estimates on historical data and realistic payment timelines rather than projected sales alone.

Step 2: Identify Cash Outflows

Next, record all expenses your business must pay. Common outflows include payroll, rent, utilities, inventory purchases, loan repayments, taxes, and insurance. Be thorough to avoid underestimating cash needs.

Step 3: Choose a Forecasting Period

- Direct method: Tracks actual cash receipts and payments (best for small businesses)

- Indirect method: Starts with net income and adjusts for non-cash items (used mainly for reporting)

Step 4: Calculate Net Cash Flow

Subtract total cash outflows from total cash inflows for each period. This shows whether your business will generate a surplus or face a shortfall.

Step 5: Review and Adjust Regularly

Update your forecast frequently to reflect actual results, delayed payments, or unexpected expenses. Regular monitoring keeps your forecast accurate and actionable.

Consistent cash flow forecasting turns financial uncertainty into clarity and control, supporting smarter decisions and sustainable business growth.

Read More: Why a Financial Statement Audit for Startups is a Game-Changer | USA | 2026

Tools for Cash Flow Forecasting

Using the right tools makes cash flow forecasting more accurate, efficient, and actionable for small businesses. These tools help track inflows and outflows, identify potential shortfalls, and support better financial decision-making without unnecessary complexity.

- Spreadsheets (Excel or Google Sheets): A cost-effective option for small businesses starting with basic cash flow forecasting and simple projections.

- Accounting Software: Platforms with built-in forecasting features help automate data from invoices, expenses, and bank transactions.

- Cash Flow Forecasting Software: Dedicated tools provide real-time insights, scenario planning, and visual dashboards for better cash visibility.

- Virtual CFO Services: Professional support offers customized forecasts, advanced financial modeling, and strategic guidance tailored to US small businesses.

- Banking and Payment Tools: Cash management dashboards from banks help monitor balances and incoming payments.

Choosing the right tools can transform cash flow forecasting from guesswork into a strategy. Learn how accurate forecasting supports smarter business decisions and sustainable growth.

How Cash Flow Forecasting Supports Better Decisions

Cash flow forecasting gives small business owners a clear picture of where their finances are headed. By understanding future cash positions, businesses can move from reactive decision-making to proactive financial planning, even in uncertain market conditions.

- Improves planning and budgeting by showing when cash will be available or constrained.

- Supports confident growth decisions, such as hiring, expansion, or equipment purchases.

- Identifies cash shortfalls early, allowing time to secure funding or reduce expenses.

- Strengthens pricing and cost control through better visibility into margins and expenses.

- Enhances lender and investor confidence by demonstrating financial discipline and foresight.

- Ensures timely payments for payroll, vendors, and taxes, reducing operational risk.

With accurate cash flow forecasting, small businesses gain clarity, control, and confidence, enabling leaders to focus on long-term growth rather than short-term financial pressure.

When to Seek Expert Support

Small businesses should consider expert support when cash flow forecasting becomes complex or time-consuming.

As revenue grows, expenses increase, and financial decisions carry higher risk, professional guidance helps ensure accuracy and strategic alignment.

Expert support is especially valuable when preparing for expansion, managing seasonal fluctuations, applying for loans, or navigating economic uncertainty.

Financial professionals can identify hidden risks, build reliable forecasts, and provide actionable insights beyond basic projections.

Seeking expert support allows business owners to focus on growth while ensuring cash flow planning remains accurate, compliant, and aligned with long-term business goals.

Read More: Virtual CPA vs Traditional CPA | Which Is Better for US Businesses | 2026

Final Thoughts

Cash flow forecasting is not just an accounting exercise; it is a strategic necessity for every small business in the United States.

By mastering cash flow forecasting, strengthening small business cash flow management, and applying disciplined financial forecasting for US businesses, owners can avoid surprises, seize opportunities, and build resilient companies.

A proactive approach to cash flow today creates financial confidence for tomorrow.